Latest News

HCSS Crowned 2024 People’s Choice Stevie® Award Winner

The award is a testament to HCSS values and reflects the commitment to delivering unparalleled service at every touchpoint.

Read More

The award is a testament to HCSS values and reflects the commitment to delivering unparalleled service at every touchpoint.

Read More

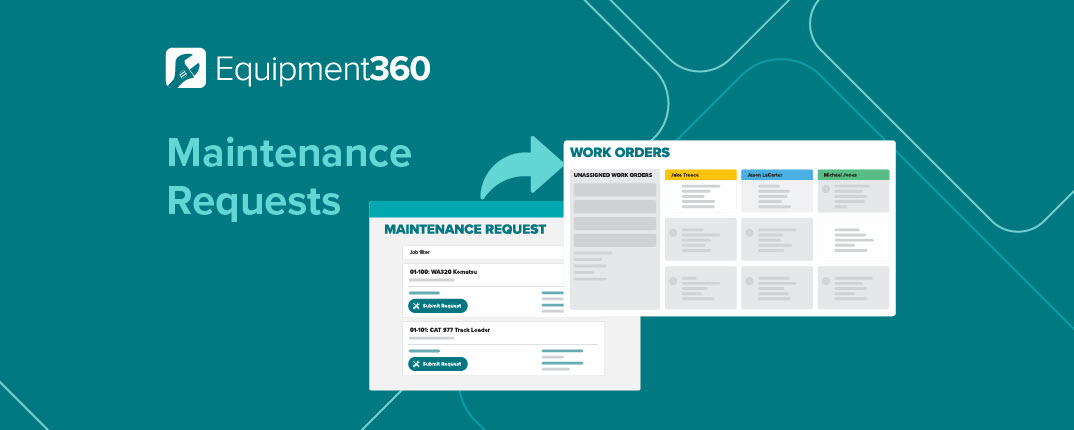

If your company owns and operates a small to midsize fleet, here’s the best solution available for ongoing equipment maintenance.

One of the most prestigious organizations in the construction industry has again recognized HCSS users as the safest companies in the business.

Once your company reaches a certain size, your team’s ability to track, manage and report on these fleet performance metrics becomes difficult without the help of software.

Small delays & errors in communication can quickly eat up your profit margins.

The help of AI in construction can enable any company with tools to plan and manage workloads more efficiently.

Here are some specific ways HeavyJob is designed to make your work life in the field more efficient.

For 17 years in a row, HCSS has consistently received the honor of being named a top workplace.

Get ready for peak season by keeping your heavy civil construction equipment in optimal condition.

Read how Milani Construction utilizes the production planner in HeavyJob to ensure the budget is being met regularly.

Get ready for peak season by keeping your heavy civil construction equipment in optimal condition.

HeavyBid Pre-Construction Can Give You the Backlog You’ve Always Wanted

This collaboration revolutionizes construction data analytics by allowing customers to harness the full potential of their entire data ecosystem.